Well Money Personal Loans 2026

At Well Money, we believe that access to financial assistance should be quick, simple, and inclusive. As a tech-driven digital lending platform, we are dedicated to serving the underserved and unbanked segments of society by offering hassle-free, unsecured personal loans.

Our Mission:

Our mission is to empower individuals who face difficulties in securing credit from traditional financial institutions. Whether it’s for an urgent medical expense, a sudden bill, or an essential purchase, Well Money ensures that fast, flexible, and reliable financial solutions are just a few taps away.

Well Money Personal Loans Who We Serve:

We are serving individuals who may not have easy access to traditional banking, including:

1) Salaried Persons – professionals and gig workers in need of short-term financial assistance

2) Self-Employed Individuals – small business owners, freelancers, and others without fixed monthly income but with consistent earnings

3) Unemployed Individuals – those currently between jobs or homemakers who may face sudden cash requirements

Age Criteria: 21 & above

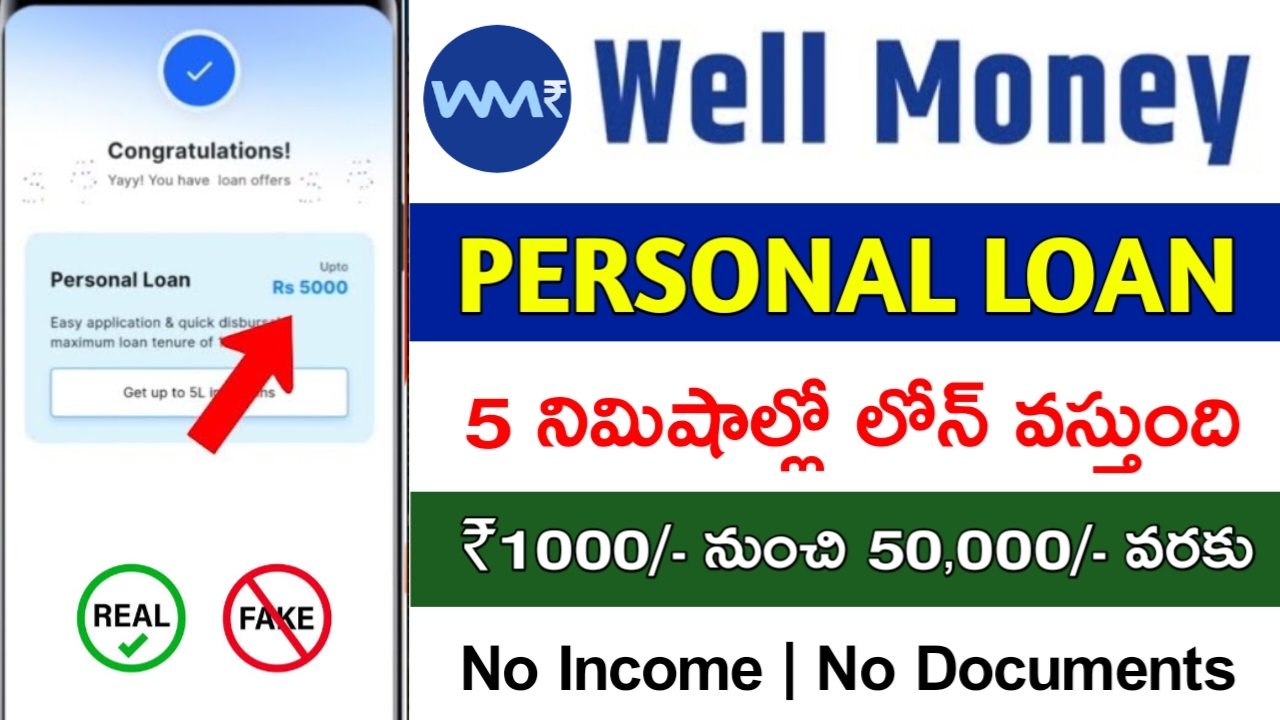

Why Choose Well Money Personal Loans?

⚡ Instant Loan Approvals – get funds in minutes with AI-powered verification

📲 100% Digital Process – no paperwork, everything via app

🔑 No Collateral Required – fully unsecured loans

📑 Minimal Documentation – apply with just PAN, Aadhaar & basic details

🔄 Flexible Repayment Options – choose a plan that fits your needs

🔒 Secure & Private – bank-grade encryption keeps your data safe

Well Money Personal Loan Highlights

– Instant Personal Loans up to ₹50,000 from RBI-registered lenders

– 100 % digital application, no collateral

– Repayment period: Minimum 90 days, Maximum 270 days

– Interest starting at 1.50 % per month

– Processing fee: up to 5 % of loan amount (+18 % GST)

– Maximum Annual Percentage Rate (APR): 60 % (including all fees and charges)

– Representative example: For a ₹10,000 loan over 3 months, total cost ₹1,040, effective APR ~41.6 %

Well Money Personal Loans Example:

“For a ₹10,000 loan with a 3-month tenure:

• Processing fee: ₹500 + GST ₹90 = ₹590

• Interest rate: 1.5 % per month

• Total repayment amount: ₹10,450

• Total cost of loan (interest + fees): ₹1,040

• Effective APR: ~41.6 %”

Well Money Personal Loan How It Works

Download & Register – Sign up on the Well Money app

Apply for a Loan – Choose your loan amount and tenure

Submit KYC – Enter PAN & Aadhaar Number

Instant Approval – AI-powered verification for quick decisions

Receive Funds – Money directly into your bank account

Repay Easily – via UPI, debit card, or net banking

Our Lending Partner Details:

(Loans facilitated from RBI Registered NBFC) Kemex Engineering Private Limited (https://kemex.co.in/privacy-policy.html)

CIN : U27101WB1986PTC040253

Registered Office : 43, PALACE COURT, FIRST FLOOR, 1 KYD STREET KOLKATA Kolkata WB 700016 INDIA

Note: Well Money (https://wellmoney.in/privacy-policy) is a mobile application owned by Swarit Advisers Private Limited (CIN: U74110UP2016PTC075854), a company registered under the Companies Act, 2013 (https://swaritadvisors.in/privacy-policy)

If you have any concerns related to this policy or want to submit a data deletion request, please contact us at:

Email: info@swaritadvisors.in

Phone: +91 7903051954

Address: 1st Floor Plot No 473, Udyog Kendra, Ecotech-III, I.A. Surajpur, Gautam Buddha Nagar, Noida, Uttar Pradesh, India, 201306.

Well Money App: Click Here

Disclaimer: This Article is for informational purposes only. We do not charge any fee for this information.